Market context

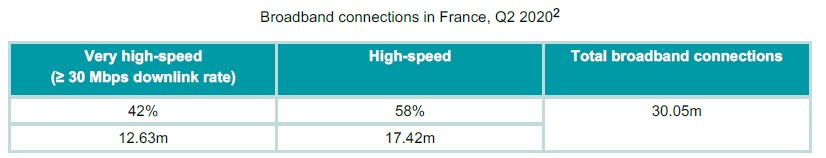

According to the French regulator ARCEP’s broadband observatory, the number of very high-speed broadband subscribers has almost reached the number of high-speed ones. ARCEP differentiates

between:

- very high-speed broadband connections: = or >30 Mbps based on FTTH, cable and FTTC; and

- high-speed broadband connections: <30 Mbps, mainly over copper.

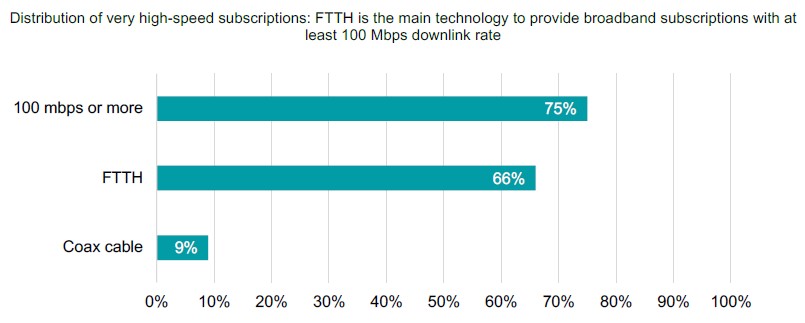

The majority of very-high speed broadband subscriptions are based on FTTH. The number of veryhigh speed broadband subscriptions over coax cable has slightly decreased over the last two years3.

When it comes to fibre rollout, Orange, the incumbent, is the leading operator with 13.18m of FTTH lines deployed, representing 63% of total FTTH deployment. SFR Group is the second operator, with 2.57m of lines.

The coaxial cable network is mainly available in the main metropolitan areas of France. It belongs to SFR Group which also deploys a FTTH network.

Main drivers for competition

Competition is mainly based on the deployment of own broadband infrastructure. Due to the average length of copper local loops, the upgrade of the incumbent legacy copper network was not seen as a viable solution for an NGA network. For this reason, a twofold regulatory framework was put in place to foster the deployment of FTTH throughout the country back in 2009 (further explained in the Regulatory approach section below).

Infrastructure competition in France is driven by four major national players:

- Orange, the incumbent operator with a nation-wide copper access network. It also leads FTTH deployments in France, covering 46% of households.

- SFR, part of Altice Group, is Orange’s main competitor. It is the main wholesale customer using wholesale access to Orange’s copper network. It also owns a coaxial cable network in urban areas and has been deploying own FTTH network.

- Free (Iliad) and Bouygues Telecom (Bouygues Group) are smaller national players, mainly competing based on wholesale access to Orange’s copper network. They also have own fibre deployments, but at a lower scale.

In 2019, Orange had the largest retail market share for broadband services provided to residential users: between 40 and 45% of the total subscribers. SFR and Free had between 20 and 25% of the market each.

The majority of copper wholesale access is based on local loop unbundling (around 90%, excluding self-supply by Orange). Wholesale access over copper provided to access seekers represented around 40% of all access solutions (taking copper, fibre and coax cable into account and including

self-supply in the scope).

For businesses services, 75% of access was provided over copper. Orange had a market share between 35 and 40% for copper products. SFR had a market share between 20 and 25%.

For services over fibre, both Orange and SFR had a market share of around 25-30% each.

Regulatory approach to wholesale broadband/NGA access regulation

The twofold regulatory approach introduced in France back in 2009 is facilitating the deployment of fibre by imposing:

- an SMP obligation on Orange to provide access to its civil engineering infrastructure (ducts and poles) at cost-oriented prices, to facilitate deployment of fibre throughout France by any operator; and

- a symmetric obligation on all operators deploying fibre inside buildings to meet reasonable access requests to the terminating part of their network. Access is to be provided at a specific location between the end user premises (basement) and the optical distribution frame. Exact location depends on the density of population. The access tariffs must be set based on the principle of non-discrimination, objectivity, relevance and efficiency.

If the regulation of access to fibre had been symmetric since its creation (same access rules for all network operators), ARCEP introduced asymmetric wholesale obligations on Orange to promote the development of FTTH services for businesses in 2017. These obligations consist in offering the same wholesale passive fibre access product for the residential market, but with additional guarantees (premium SLAs).

Fibre rollout is gradually taking place in the country based on two geographically differentiated approaches:

- For large cities and mid-dense areas, deployment is led by private initiatives, either from network operators own commercial deployment (large cities) or following binding commitments (mid-dense areas), but without public funding. The binding commitments format for mid-dense areas was put in place in 2018 to ensure that operators announcing deployment in some middense area would effectively deploy.

- In rural areas, where private initiatives would not be economically viable, networks are deployed based on public initiatives. Regional or local authorities initiate calls for tender to select one operator in charge of deploying fibre on their territory based on a public service delegation. Deployment is financed with state aid from local authorities and specific funding by the French government.

Elements of equivalence and non-discrimination

Orange is a vertically integrated operator, providing both retail and wholesale services. There is not any form of separation applied to its structure. Wholesale operations are dealt with by Orange Wholesale France, a specific division inside Orange. It deals with sales and purchase of fixed and mobile wholesale services for Orange Group in France. This division has its own director.

Until 14 December 2020 non-discrimination obligations imposed on Orange following the analysis of M3a and M3b/2014 were based on EoO. EoI was imposed only for access to ducts. For EoO, ARCEP monitored whether access seekers benefited from a quality of service comparable to Orange Retail through the monthly publication of KPIs. ARCEP explained that KPI results reveal that the quality of service observed for Orange Retail is, in many cases, lower than that of access seekers.

EoO also applied to the symmetric fibre access obligation imposed on all operators deploying fibre inside buildings11.

In 2017 ARCEP questioned on the need to introduce stronger non-discrimination obligations on Orange as it was becoming the leading operator in fibre deployment.

Although smaller operators requested immediate introduction of EoI, ARCEP maintained the EoO approach in its final decision, taking into account Orange’s commitments to strengthen technical and operational processes for the access to its fibre network12. Orange committed to improve FTTH information systems and processes to guarantee equal treatment between third party network operators and Orange’s retail services.

In 2019, after monitoring how Orange implemented its commitments, ARCEP approved13 Orange’s improvements in particular on the eligibility processes, customer premises identification tools and ordering platforms.

On 15 December 2020, ARCEP adopted new decisions on the fixed broadband markets14. As more vertically integrated operators are active on the fibre market, ARCEP strengthened the nondiscrimination obligation imposed on all infrastructure operators (symmetric regime)as regards the access to information.

EoI becomes the rule to access information systems, and for technical and operational processes. Nevertheless, the authority allows for derogation if strict application of EoI would generate excessive costs due to the development of specific tools or internal reorganisation.

ARCEP did not impose on Orange specific non-discrimination obligation for access to fibre under the SMP regime. Instead, the regulator will make sure Orange implements its commitments to improve technical and operational processes, as it had committed to.

The regulator introduced one exception though: an EoI treatment applied to some extent in the provision of passive access over fibre for the business services with a 4-hour service guarantee.

In the newly defined market for physical infrastructure access, covering ducts and poles suitable for the deployment of fibre and masts, Orange must provide non-discriminatory access to its infrastructure, based on EoI, except if the infrastructure is used to deploy backhaul networks, where it is sufficient to ensure that the wholesale conditions are comparable to those provided by Orange for its own operations.