Market context

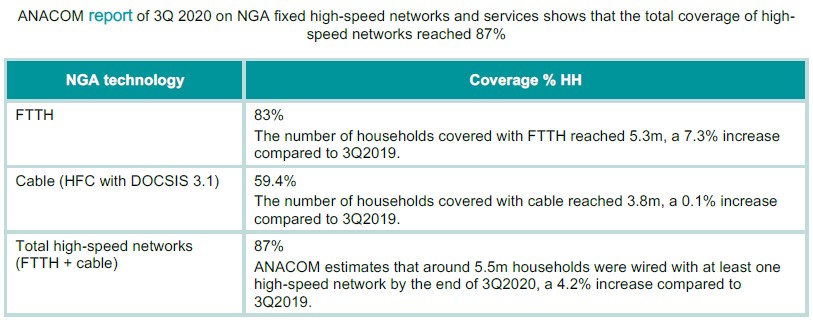

In Portugal, FTTH and cable (HFC with DOCSIS 3.1) are the main NGA technologies providing highspeed broadband connectivity (at least 30 Mbps transmission speed) to households.

Take-up of broadband of at least 30 Mbps in 2019 stood at 61.4% of households, above the European Union (EU) average of 48.7%, while take-up of broadband of at least 100 Mbps was 56%, well above the EU average of 26%.

Historically, NGA availability in Portugal has been increasing at both national and rural level in the last five years. According to the latest European Commission’s study on broadband coverage, in 2019 Portugal stood slightly below (94.9%) the EU average for fixed broadband16 (97.1%) as well as below (83%) the EU average for NGA broadband17 national level (85.8%). However, Portugal surpassed the EU average broadband coverage in rural areas for both the abovementioned categories.

In 2009, the government launched five public tenders for the deployment and operation of next generation broadband networks in five rural areas not served by NGA networks. The tenders were technology neutral, requiring that each final client would be able to obtain download speed of at least 40Mbps. The winning bidders were DSTelecom in Alentejo, Algarve and in the North region, as well as Viatel (Fibroglobal was the company set up by Viatel for this purpose) in the Centre region, Azores and Madeira.

Following the abovementioned public tenders, the government further pursued its policy to promote deployment of NGA networks through a national broadband strategy adopted in 2012 and updated in 2015 with the action plan Portugal Digital.

Main drivers for competition

Public investment and infrastructure-based competition among private operators are the two main drivers for the upgrade of basic broadband networks in NGA ones (FTTH and cable).

As far as public investment is concerned, the government promoted NGA networks deployment in Portugal through state aid.

As mentioned above, according to the action plan Portugal Digital, the government set the goals to reach a coverage of at least 30 Mbps for 100% of the population and a coverage of at least 100 Mbps for 50% of all households by the end of 2020.

Although there are no specific regulatory obligations applicable to NGA networks, the telecoms regulator (ANACOM) focused on boosting infrastructure-based competition by enforcing:

- duct and pole access obligations;

- NGA coverage subsidies and investment commitments (e.g., subsidies in rural areas and joint investment between operators);

- a set of provisions aimed at ensuring open access to infrastructure (e.g., piping networks, masts, ducts, etc.) capable of housing electronic communications networks (already deployed and/or under construction); and

- the set-up of the Suitable Infrastructure Information System to assure the provision of information relative to the infrastructures suited for the accommodation of electronic communication networks.

The consolidation of NGA in Portugal started in 2013 with the merger between the cable operator ZON and Optimus, which led to the establishment of NOS. The subsequent decrease of the incumbent operator (MEO) market shares benefited its two biggest competitors NOS and Vodafone, which constitute the other two nationwide vertically integrated network operators.

ANACOM reported that the abovementioned three operators had significant broadband access market shares in Portugal at the end of the first half of 2020. Specifically, MEO had the highest share of residential accesses (38.8%), followed by NOS (37.7%) and Vodafone (19.3%).

Regulatory approach to wholesale broadband/NGA access regulation

Historically, the regulatory approach to NGA access regulation was focused only on regulating access to passive infrastructure such as ducts, poles and in-building wiring. The regulatory framework for access to passive infrastructure has been defined by two sets of regulation, symmetric and asymmetric.

In the context of market analysis procedures (asymmetric regulation), ANACOM required MEO (former Portugal Telecom), the SMP operator, to publish a reference offer for access to its ducts and poles infrastructure. In parallel, a Decree-Law no. 123/2009 introduced a set of provisions aimed to ensure an open access to present and future passive infrastructures that are suitable for the accommodation of electronic communications networks (symmetric regulation).

Furthermore, ANACOM has never applied asymmetric SMP regulation of MEO’s fibre network and wholesale central access to its copper network has been progressively deregulated in more competitive areas since 2009.

In the context of the latest analysis of fixed broadband markets, ANACOM approved the final decision on market 3a/2014 and market 3b/2014 in March 2017. These decisions maintained MEO’s designation as having SMP in both markets.

In market 3a/2014, ANACOM decided to maintain on MEO the obligations of local loop unbundling for copper18 as well as access to ducts and poles.19 In addition, MEO is subject to the obligation of providing access to dark fibre whenever there is no space in existing poles or ducts. The offer of dark fibre may be included in existing reference offers on access to ducts and poles or constitute an autonomous reference offer.

ANACOM did not impose an access obligation on MEO’s fibre network neither in competitive nor in non-competitive areas (e.g., rural areas). By adopting this approach, ANACOM did not follow the Commission's Recommendation of November 2016 requiring the imposition of a wholesale obligation for MEO to provide local unbundling and bitstream access over fibre in non-competitive areas. Nevertheless, the regulator stated that it would continue to monitor the FTTH market evolution, with a special focus on non-competitive areas, and possibly assess it in a new market review.

As far as market 3b/2014, ANACOM concluded, similarly to its previous analysis, that the existence of various competitive conditions at retail level in different geographic areas justified the definition of two sub-national markets (non-competitive and competitive areas).

Thus, the regulator designated MEO has SMP operator in non-competitive areas where it decided to impose an obligation for copper accesses. ANACOM decided not to impose on MEO an obligation to access fibre in market 3b/2014, following the decision already taken for market 3a/2014.

An area is deemed competitive and with no remedies imposed on operators if:

- there are at least two ANOs, as well as MEO, and each ANO has more than 50% NGA coverage (NGA meaning fibre and cable DOCSIS 3.0); or

- there is one ANO with more than 50% NGA coverage and MEO’s retail market share in the parish is below 50%.

For both markets, ANACOM imposed further transparency and cost-oriented pricing obligations in order to prevent potential competition problems, such as excessive prices or discriminatory practices.

Elements of equivalence and non-discrimination

MEO is a vertically integrated operator, providing both retail and wholesale services. There is no form of separation applied to its structure. The operator uses its own infrastructure and network to provide retail access services, as well as support for other electronic communications services of the group.

As far as market 3a/2014 is concerned, MEO is subject to a non-discrimination obligation regarding access to LLU and SLU and auxiliary facilities. ANACOM imposed:

- EoI for duct and pole access; and

- EoO for LLU and dark fibre.

When implementing the abovementioned equivalence models, MEO shall ensure that technical replicability, effective implementation of SLAs, compensation and KPIs in the main regulated wholesale services is implemented “not later than six months as of the imposition of the EoI obligation”.

In addition, MEO shall include the SLAs and the compensation for non-compliance with the service quality levels effectively ensured in the provision of wholesale services and shall also publish the KPIs related to dark fibre provision. For the dark fibre offer, MEO shall apply the principles set out in ANACOM decision of 11 March 2009 on the publication of the QoS performance indicators. It should be stressed that, within the scope of this decision, to each SLA shall correspond a KPI. Furthermore, in the definition of SLAs, MEO shall also take into consideration the principles adopted in ANACOM decision of 28 March 2012 on the procedures to be followed in the assessment of the service quality of the regulated wholesale offers.

In market 3b/2014, ANACOM imposed non-discrimination obligations following EoO on MEO. The key elements are to:

- implement EoO in the provision of wholesale broadband access services;

- ensure technical replicability in the wholesale central access services provided at a fixed location (for major consumer products);

- assure two months’ notice before MEO can change wholesale offers on its own initiative (in the case of non-significant changes with no direct impact on retail offers, this period shall be of one month); and

- • launch retail offers subject to the existence of equivalent wholesale offers.