Market context

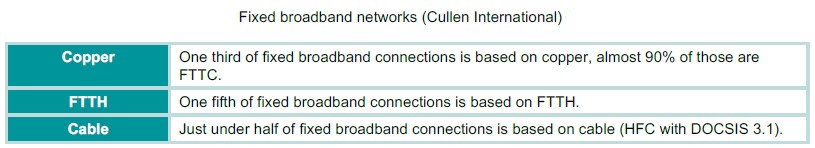

The Netherlands is a small, densely populated country. Almost all households (94%) subscribe to a fixed broadband service. The vast majority of broadband lines (>90%) have speeds above 30 Mbps and almost half (47%) have speeds above 100 Mbps (ACM Telecommonitor 3Q 2020).

KPN, the incumbent operator, and VodafoneZiggo, a cable operator, each have about 45% of the retail broadband market. The final 10% is served by T-Mobile, who acquired the Dutch subsidiary of Tele2 in 2019, and a number of small local cable and fibre operators (ACM Telecommonitor 3Q 2020).

KPN deploys a combination of FTTC and FTTH which cover 56% and 33% of households respectively (KPN Quarterly Report 3Q 2020). These networks are mainly deployed in urban and suburban areas and the footprints largely overlap.

Cable operator VodafoneZiggo, owned by Liberty Global, covers 98% of households with DOCSIS 3.1 (Liberty Global).

Main drivers for competition

Competition in the retail broadband market is mainly driven by infrastructure competition between KPN, with FTTH and FTTC, and VodafoneZiggo, with cable. Both operators are vertically integrated and are present all over the country.

KPN acquired sole control of Reggefiber in 2014, a joint venture investing in local fibre access typically offering fibre connections in one city or one municipality. Reggefiber was a subsidiary of Reggeborgh, a Dutch real estate developer. Reggeborgh used it to connect its new developments, mainly multi-dwelling buildings in urban and suburban areas, with fibre.

That same year, UPC Netherlands merged with Ziggo to form the largest Dutch cable operator with a national footprint. In 2017, Vodafone Netherlands created a joint venture with Ziggo to form VodafoneZiggo, offering fixed and mobile broadband services (VodafoneZiggo). This resulted in two operators, KPN and VodafoneZiggo, offering fixed and mobile broadband services all over the Netherlands with their own infrastructure.

In some local areas, small operators compete with both KPN and VodafoneZiggo. The largest of these is Delta. It is vertically integrated and operates both a cable and a fibre network in some areas of the Netherlands (Delta NL).

Several of these small local operators work under a wholesale-only model and rely on third party ISPs to offer internet services over their networks.

T-Mobile and other ISPs rely on wholesale access provided by KPN, on both regulated and commercial basis.

About 40% of wholesale access is based on regulated unbundling (over copper or fibre) and 60% of wholesale access is based on commercial virtual unbundling (VULA) or bitstream. VULA and bitstream are both part of the same commercial wholesale broadband reference offer (KPN).

Regulatory approach to wholesale broadband/NGA access regulation

The current regulator ACM, the authority for consumers and markets, was formed in 2013 by merging the consumer protection authority, the competition authority and the telecoms NRA OPTA.

Historically, OPTA/ACM has prioritised local loop unbundling as a means to stimulate infrastructure competition. The main wholesale buyer was Tele2, now part of T-Mobile.

KPN has always offered wholesale broadband access (WBA, bitstream) on commercial basis.

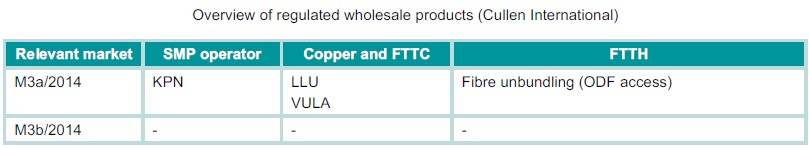

In its market analysis of 2018, ACM concluded that there is a risk that KPN and VodafoneZiggo have joint dominance in the retail broadband market and imposed remedies on both operators in the wholesale market (ACM).

However, this decision was annulled by the Dutch trade and industry appeals tribunal in March 2020. The court rejected ACM's analysis, concluding that it had not sufficiently justified that VodafoneZiggo and KPN have the ability and incentive for tacit collusion, neither in the retail or in the wholesale market.

With this annulment, the previous round of market analysis remains in force, where market 3b has been deregulated since May 2012 and market 3a has just KPN designated as having SMP.

In practice, VULA is part of the commercial wholesale broadband offer (bitstream) and is available over copper, FTTC and FTTH. ACM can step in and set regulated prices if a commercial agreement cannot be reached.

Most wholesale buyers of LLU, like T-Mobile (Tele2), are migrating their installed base to VULA in order to upgrade their broadband offers to higher speeds.

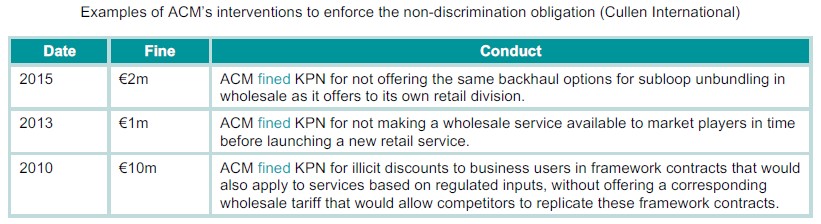

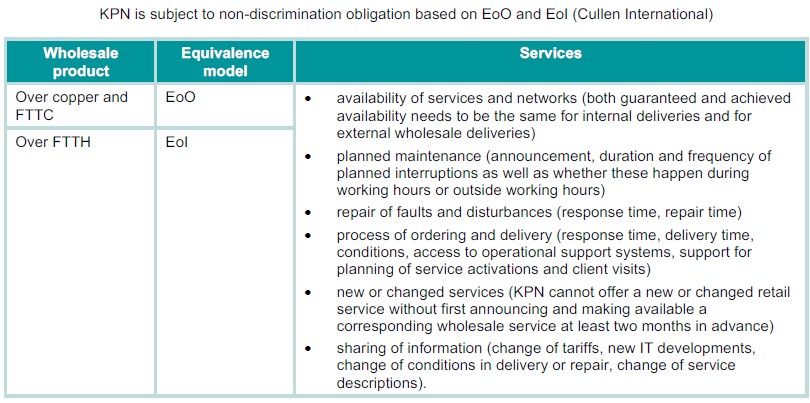

Elements of equivalence and non-discrimination

The incumbent operator KPN is vertically integrated. KPN has an internal wholesale division with careful management of information flows (Chinese walls). VodafoneZiggo, the cable operator, does not offer wholesale access to its network.

KPN must include SLAs and SLGs in its reference offers. The parameters of both SLAs and SLGs were agreed between KPN and market players. The regulator can impose changes to either of these upon request of market players as part of a dispute resolution.

Every quarter, KPN must send a report of its performance to the regulator and to market players.

These KPI reports are not public. The regulator can see all reports. Market players only see KPN’s performance for themselves and for the market as a whole.

Access seekers have the option to themselves install or repair lines for their customers. Only certified engineers can enter KPN’s technical buildings to perform works. These works are not included in the performance reports.

A price squeeze test applies based on an equally efficient operator (EEO) efficiency standard. Before the launch of a retail broadband offer, KPN must internally perform a price squeeze test. KPN does not need an explicit approval to launch a retail offer. Every quarter, KPN must send a report to ACM, who may investigate in case of doubts or complaints. These reports are not public and only accessible by the regulator, not by market players.

Neither a technical replicability test (TRT), nor an economic replicability test (ERT) is imposed. In its decision, ACM stated that applying an ERT, as prescribed by the Commission recommendation on costing methodologies and non-discrimination, would limit KPN's pricing flexibility and have a negative impact on KPN's business case.

Wholesale prices for LLU over copper are regulated with a price cap that is set at the cost-oriented prices established in 2011 adjusted for inflation. This is to avoid a significant increase in the costoriented copper price as a result of the migration to fibre, when a largely unchanged cost basis would be allocated to fewer lines.

Wholesale prices for VULA over FTTC are unregulated. Shortly before ACM adopted its market analysis, KPN agreed with market players on a reference offer for VULA with commercial prices. In case of complaints, the regulator will step in and may set cost-oriented prices.

Wholesale prices for fibre unbundling (ODF access) are subject to a multi-year price cap. The caps allow KPN to obtain a reasonable return on investment. This reasonable return includes a risk premium on top of the regulated weighed average cost of capital (WACC). Every year, the regulator analyses the internal rate of return (IRR) of a discounted cash flow (DCF) model based on KPN’s business model. If the IRR is higher than the reasonable return, wholesale prices will be adjusted to compensate. A lower-than-expected IRR remains at the risk of KPN, it cannot increase wholesale prices to compensate. The DCF model and its analysis are not public.