Market context

In Spain, NGA technologies are based on FTTH and cable (HFC with DOCSIS 3.1). FTTH is the prevailing NGA technology in terms of coverage. In June 2020, the incumbent FTTH network covered 95% of real estate (RE) units out of 25m RE in total, including both homes and retail premises. Cable, instead, covered 48.9% homes in June 2019 according to the Ministry for Digital Transformation.

In terms of take-up, FTTH plays also the main role. Close to 70% of total residential broadband lines in 1Q 2020 (8.93m out of 12.7m lines) were FTTH lines, compared to 1.8m cable residential subscriptions in the same quarter (CNMC data).

Historically, FTTH coverage and take-up have followed a consistently ascending trend, while cable coverage and subscriptions remained relatively stable (CNMC data).

Public aid played a big role for rural FTTH deployment by progressively reducing the coverage gap in rural areas versus urban areas. The nationwide PEBA broadband aid scheme launched in 2013 granted public aid for the deployment of very high-speed broadband networks capable of providing speeds of 300 Mbps (the speed limit was increased in 2020 from 100 Mbps) in white and grey areas.

From 2013 to 2019 PEBA granted €478.9m in public aid (the majority of selected projects being FTTH networks). An envelope of €400m is available for the period 2020-2022. The goal is to extend NGA coverage at 300 Mbps to 100% population centres and 95% of the Spanish population by 2021.

Main drivers for competition

Spain focused on NGA infrastructure competition from an early stage. The incumbent (Telefónica) competes with other three nationwide vertically integrated network operators (Orange, Vodafone and MasMóvil). These four operators compete in retail broadband services largely using their own NGA network, especially in urban areas.

Telefónica accelerated its FTTH (GPON) network roll out from 2014. At the time, Orange and Vodafone lacked a similar NGA footage and had no regulated wholesale access to Telefónica´s fibre.

This led to different acquisitions and consolidation in the market:

- In 2014 Vodafone acquired ONO, the largest cable operator in Spain with a cable network in several regions.

- In May 2015 Orange acquired Jazztel, an alternative operator which had deployed 3.67m FTTH RE units.

- In July 2015, Orange sold 700,000-800,000 of Jazztel´s FTTH RE units to MasMóvil. This was not a commercial operation, but an action required to meet the conditions imposed by the European Commission on Orange to approve its previous Jazztel acquisition. In the view of the Commission, this sale enabled MasMóvil (fourth nationwide player) to compete effectively in fixed internet access.

All four operators have intensively deployed their NGA. According to CNMC, Telefónica had 24m FTTH installed accesses, Orange 15m FTTH accesses, Vodafone 11.2m accesses (7.5m of which on cable), and MasMóvil 8.3m FTTH accesses in 1Q 2020.

As far as the wholesale broadband market is concerned, Telefónica had a 80.2% share (3.4m out of 4.3m wholesale broadband lines in total) in 1Q 202021. Alternative operators make use of Telefónica´s regulated wholesale broadband services (full LLU connections are progressively decreasing to the benefit of VULA and the bitstream access service NEBA over FTTH lines).

As a result of infrastructure competition, commercial co-investment and sharing agreements among network operators are of significant importance in the Spanish wholesale market. Telefónica can also freely enter into such commercial wholesale fibre access agreements without prior approval from CNMC. Nonetheless, the operator must notify such agreements to the regulator and respect nondiscrimination obligations.

Telefónica has already subscribed bilateral non-exclusive agreements with Vodafone and Orange respectively in 2017 and 2018, granting these operators access to its FTTH network at “competitive prices”. Such agreements provided access to these alternative operators also in municipalities where Telefónica has no fibre access obligation, in exchange for minimum purchase commitments.

Alternative network operators have also signed (i) FTTH access and (ii) build and share agreements (e.g., MasMóvil and Orange). These are commercial agreements, concluded inter alia, and not subject to regulation.

There is no significant competition from wholesale-only operators in the fixed market. Pentacom, a joint venture approved by the European Commission in March 2020, is the sole wholesale-only fixed operator that exists in Spain.

Taking into consideration the retail broadband market, competition shows Telefonica having a national 38.3% market share (34.92% if we only consider residential lines) in 1Q 2020 (CNMC).

Telefónica´s closest competitors at the retail level are convergent nationwide operators Orange, Vodafone and MasMóvil. Telefónica and these three operators accounted for the vast majority (94.4%) of the retail fixed broadband market in 1Q 2020 (CNMC). Retail competition is based on convergent bundles offered nationwide, with no geographic price differentiation. Convergent (fixedmobile) bundles have grown from 68% in 1H 2015 to almost 100% of the broadband market in 2020.

Regulatory approach to wholesale broadband/NGA access regulation

Spain´s independent telecoms regulator, CNMC, was set up in 2013 as a converged regulator supervising several sectors and acting also as national competition authority. Until 2013 the telecoms regulator was CMT.

Infrastructure competition based on NGA in Spain translated into wholesale broadband access markets being partly deregulated.

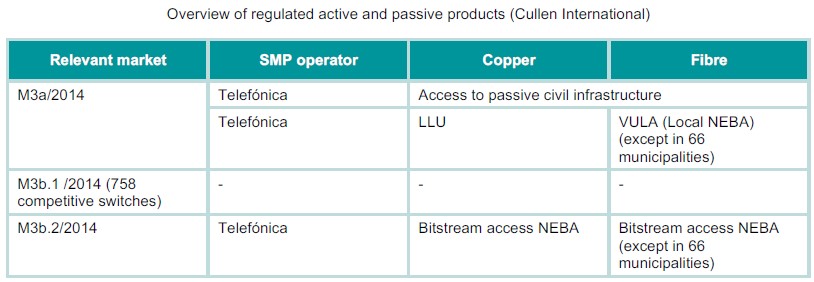

Under CNMC´s decision of 24 February 2016 on the analysis of markets 3a and 3b/2014 Telefónica has no regulatory obligation to offer FTTH wholesale services in 66 municipalities (representing 35% of the Spanish population) and no obligation to offer bitstream access (over copper or fibre) in 758 competitive switches (or 58.4% copper pairs).

Prior to CNMC´s 2016 decision, access to Telefónica´s FTTH network was totally unregulated. The previous Spanish telecoms regulator (CMT) considered that regulation should focus on infrastructure competition, and only address the bottlenecks that could hinder such alternative NGA deployment.

This meant regulating access to Telefónica´s ducts and access to in-building wire of the first-tobuilding operator.

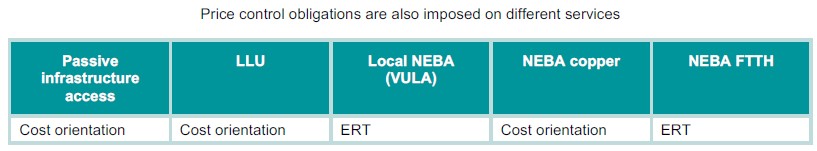

Since 2009, Telefónica must grant regulated access to its passive infrastructure at cost-oriented prices. The first reference offer for passive infrastructure access dates from November 2009. CMT and later CNMC intervened regularly to review the offer, clarify its scope, and solve disputes.

Regulated ducts access has been used widely by alternative operators to deploy their own NGA networks.

Also, in February 2009, CMT imposed a symmetric obligation on the first-to-building operator to grant access to in-building fibre at commercially agreed prices, subject to its intervention in case of dispute.

Operators concluded agreements (the first of which signed by Telefónica and Jazztel in 2012) to deploy FTTH and share in-building fibre. CMT intervened to solve several disputes.

Elements of equivalence and non-discrimination

There is no separation of the incumbent operator, Telefónica is vertically integrated.

Telefónica is subject to a non-discrimination obligation in markets 3a and 3b/2014, regarding access to passive infrastructure, LLU, Local NEBA (VULA) and bitstream NEBA.

Non-discrimination is based on EoO. CNMC declared that although Local NEBA and NEBA “do not meet the features of a strict EoI, they are close to such characteristics”.

The key elements of the non-discrimination obligation imposed on Telefónica are:

- Conclude in writing any agreement with third parties, its own subsidiaries and other Telefónica group companies and notify them to CNMC within 10 days.

- Periodically notify CNMC, and make available to ANOs, the KPIs defined by the regulator for wholesale services and equivalent internal services.

- Include SLAs and SLGs for relevant services in reference offers approved by the regulator.

- Provide information to ANOs of the same quality and at the same time as to its own internal divisions on its wholesale web services system, including the actual and planned (within 3 months) coverage of Telefónica´s FTTH network in switches where the regulated service is available. CNMC has intervened to modify Telefónica´s regulated web services system to ensure that “equivalent” coverage information is provided to ANOs as is available to Telefónica´s retail divisions (e.g., CNMC decision of 30 March 2017).

- Technical replicability test (TRT) of all retail broadband offers, and economic replicability test (ERT) of flagship offers.

For copper, in addition to cost orientation obligations, CNMC performs a pre-launch ERT on Telefónica´s retail flagship copper offers.

Fibre products are only subject to an economic replicability test (ERT) performed ex ante on a catalogue of flagship offers (CNMC reviews the test parameters and updates the list of flagship offers every six months). The ERT is based on an EEO efficiency standard.

To determine Telefónica´s s retail costs under the fibre ERT and allow CNMC to enforce the nondiscrimination obligation, Telefónica must implement a regulated cost accounting system, and keep separated accounts for its wholesale fibre services. Separate accounts must ensure that access provided to Telefónica´s business divisions, subsidiaries and group companies is equivalent to that provided to third parties and “show the absence of cross-subsidisation between regulated services and other activities”.

The decision approving the ERT imposed additional information obligations on Telefónica. This operator must notify to CNMC monthly the clients subscribing to its retail broadband offers and promotions, NEBA and Local NEBA lines and income, and any access lines and income from commercial wholesale fibre services offered to third parties (per concept and operator). Any wholesale discounts must be reported separately.

CNMC has intervened to enforce the non-discrimination obligation. Examples of this enforcement action are:

- In July 2017, CNMC fined Telefónica €3m for discriminating against competitors during and after a strike of Telefónica´s contracted technicians in 2015.

- In 2019, CNMC fined Telefónica €3m for using FTTH optical distribution frames (ODFs) that it had previously designated as not available for competitors.

- In 2019, CNMC fined Telefónica €6m for applying longer provisioning and fault repair timers when providing regulated wholesale bitstream access service NEBA than it did when providing equivalent services to its own retail arm.

- In 2020, CNMC fined Telefónica €400,000 for infringing its information obligations under the fibre ERT.

CNMC has consulted interested parties until 19 December 2020 on the proposed review of its 2016 analysis of markets 3a and 3b.

The current proposal (which is subject to modifications and has not been notified to the European Commission yet):

- Does not change the regulatory approach to wholesale broadband/NGA access regulation described in this report.

- Increases geographic deregulation based on a new delimitation of sub-national markets (both in markets 3a and 3b) that takes account of lively NGA infrastructure competition. It is therefore proposed that in 592 municipalities (representing 67% of the Spanish population) Telefónica would not be under a regulatory obligation to offer FTTH wholesale services or bitstream access over copper.

- Maintains the elements of equivalence and non-discrimination described in this report.